Vol Trader

Vol Trader

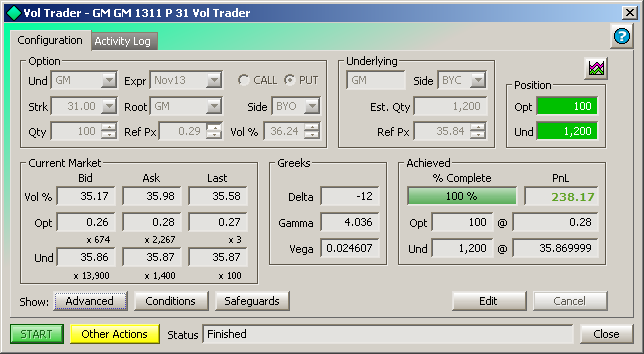

Vol Trader works by trading an option hedging with its underlying product based on market volatility. An option symbol is defined along with side types and percentage of volatility. A Vol Trader is marketable when (1) buying options with a volatility percentage greater or equal to the ask volatility or (2) selling options with a volatility percentage less than or equal to the bid volatility.

With the Managed Order Console selected type Ctrl + Shift + o.

Alternate Methods:

From

the Action menu

in the Managed Order Console, select New

Managed Order -->Vol Trader

Right-click in the Managed Order Console grid and select New Managed Order -->Vol Trader

Note: Vol Trader can also be launched via the Vol Trader button in the Option Quote Cube.

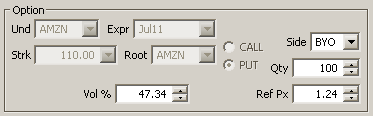

In the Option section of the Vol Trader window enter values for each field:

Und—The underlying security.

Select from the drop-down list or type a symbol name.

Expr—The option's expiration

date.

Strk—The strike price.

Root—The unique option class

identifier.

Call/Put—Select the type of

option order.

Option Side Type—BYO (Buy to

open), BYC (Buy to close), SLO (Sell to open), SLC (Sell to close).

b—The desired number of option

contracts to trade.

Ref Px—The reference price.

Vol %—Volatility percentage. This value is based on the option and underlying reference prices, though it can be edited once Vol Trader has started. The volatility percentage increases or decreases in direct correlation to the reference price.

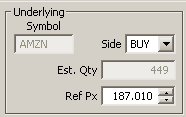

Set Up the Underlying Stock Symbol

Vol Trader automatically assigns the underlying security to match the option symbol. Consequently, the Underlying Symbol field cannot be edited.

Option Sides Types and the Underlying Stock Side Types

The side type of the underlying security is determined by two factors: the option type (call or put) and the option's side.

Option Type |

Option Side Type |

Underlying Symbol Side Type |

Call |

BYC or BYO |

SEL, SLA, or SSH |

Call |

SLC or SLO |

BUY or BYC |

Put |

BYC or BYO |

BUY or BYC |

Put |

SLC or SLO |

SEL, SLA, or SSH |

Here, the Ref Px refers is the reference price of the underlying security.

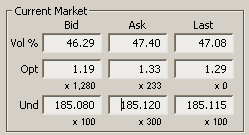

The current market's option and underlying Bid/Ask/Last prices are displayed in the Current Market area of Vol Trader. The volatility percentage values are also displayed.

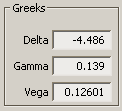

Greeks measure an option's sensitivity to risk components.

Delta measures the rate of change in the option price over the rate of the change in the underlying security.

Gamma is the ratio of the change of an option's Delta to a small change in the price of the underlying security.

Vega is the measurement of the sensitivity of an option's price to a change in its implied volatility.

Note: Greek values are calculated by WEX and cannot be edited.

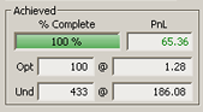

The non-editable Achieved section displays the current status of Vol Trader:

Percentage

complete

PNL

(Profit and Loss) amount (profit displayed in green, loss displayed in

red)

Number

of options traded and price

Number of underlying shares traded and price

Note: The option and underlying prices are the average prices.

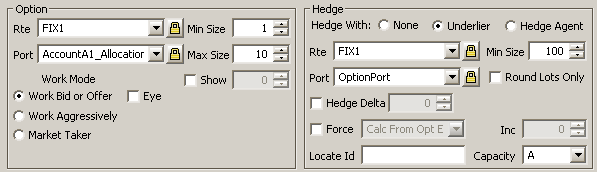

Option Parameters

Press the Advanced button to select the following:

Rte

(Route)—The route(s) to which option orders will be sent (click

here for Option Quote Source

route information).

Note: If more than one

route is selected, Vol Trader with fanout the order as equally

as possible among all routes.

Port(folio)—The

portfolio in which option orders will exist (as defined in Global Configuration).

Note: Both Rte and Port

selections can be locked from making accidental changes. Press

the lock button  to invoke this option.

to invoke this option.

Show

(optional field)—For reserve orders this value represents

the quantity that should be shown to the world.

Note: Field is disabled if the selected route does not support

reserve orders.

Min(imum)—Size

specifies the minimum order size.

Max(imum)—Size

specifies the maximum order size.

Work

Mode

Work Bid or Offer—This mode places option orders to buy

at the bid or sell

at the ask when

market conditions are valid.

Eye—The Eye feature enables the Work

Bid or Offer mode to place an IOC (Immediate

or Cancel)

option

order to buy

at the ask or sell

at the bid to try

and capture marketable liquidity before falling back to its default

behavior. To

use this feature, the Vol Trader must be in Work Bid or Offer

mode and the configured option route must support a Time In Force

of IOC. It is highly recommended to use this feature

with a WEX smart router such as Xenon for orders to capture liquidity

reliably.

Work Aggressively—The initial order will be placed at the

most aggressive price allowable without violating the desired

limit. This may, or may not, result in the initial order taking

liquidity.

Market Taker—The initial order is only placed when the desired

limit is currently achievable in the marketplace. It will only

take liquidity.

Hedge Parameters

Hedge With:

Rte

(Route) for underlying stock symbol (click here for information on route

configurations).

Port(folio)

(as defined in Global Configuration).

Note: Both RTE and Port selections can be locked

from making accidental changes. Press the lock

button  to invoke this option.

to invoke this option.

Min

Size—The minimum order size.

Round

Lots Only—Check this box if it's preferable to trade shares

in round lots only.

Force (side

type)—To force a hedge trade to be placed with the

specified price type, select a side type from the drop-down list.

If Calc Price From Option Exec is selected, Vol Trader will determine

the underlying security's price based on the option's sale price

and the defined volatility value.

Inc(remental)—Used with Calc

Price and Force.

Note: The increment cannot

be adjusted if the price type is Market.

Disable Hedge Side—If checked,

only option side orders will be placed.

Hedge Delta—Check this box to

specify a delta value which, in turn, will be used in computing

the Est. Qty of an underlying symbol.

The Est. Qty is computed as follows: Hedge Delta x Qty =

Est. Qty

If Hedge Delta is not checked, the market delta will be used when

calculating the Est. Qty value.

Note: A warning message

displays whenever a Hedge Delta value is applied. The message

states that a defined underlying quantity will not change with

the market.

Locate ID—This field is used as part of SEC Regulation SHO for short sales. This regulation includes a new uniform requirement for broker-dealers to locate securities available for borrowing prior to effecting a short sale. Both numbers and letters can be used in a Locate ID, but there is a 16-character limit.

An unfilled Vol Trader order can have its sides reversed. For example a Vol Trader with a buy side and an underlying sell side can be switched:

Original Vol Trader Order |

Vol Trader Reversed |

Once a Vol Trader order has been selected to be reversed, the new Vol Trader order will display with the word "Reversed" in the title bar.

With the reverse feature, Vol Trader can be configured to reverse those quantities that have already been filled, or the entire Vol Trader order.

Right-click

on a Vol Trader order in the Managed

Order Console and select Reverse

Vol Trader.

Select either

Reverse Filled Quantities

or Reverse Entire Vol Trader.

![]()

A reversed Vol Trader window will open. Make any desired changes and press Start to start the reversed order.

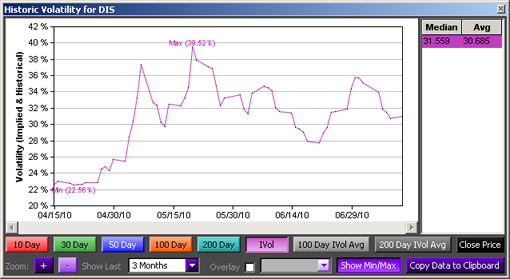

Press

the Volatility Chart Viewer

button ![]() to launch the chart.

to launch the chart.

The Volatility Chart Viewer graphs volatility data for a security over selected time periods. If the underlying security in Vol Trader changes, the Historic Volatility Chart will change accordingly.

To learn more about the Volatility Chart Viewer click here.

Calculate Vol Trader Percentage from Reference Prices

|

|

|

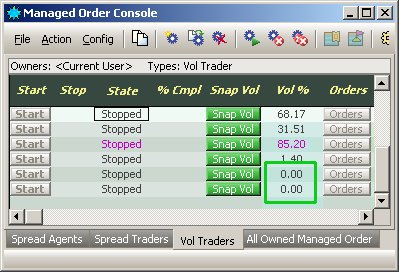

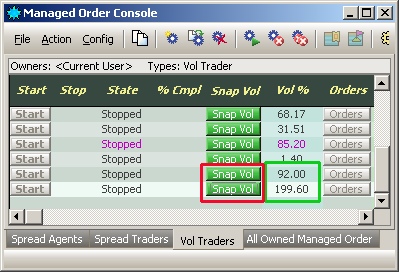

| Vol % is 0.00 for imported Vol Trader orders | Vol % is calculated when Snap Vol is selected |

Unless specifically defined in a

Vol Trader import file, imported Vol Traders do not have an associated

Vol % value. This is due to the fact that a Vol % value is dependent

on a number of factors including a security's reference price, an

underlying security's reference price, and current market conditions.

Consequently, the Managed Order Console will display the Vol % of imported Vol Traders as 0.00 unless one of the following occurs:

The order is opened for viewing,

at which point the Vol % will be calculated.

The Vol Trader button Snap Vol is selected. The Vol % will be calculated and displayed without the need for opening the order.

Add the Snap Vol column to the Managed Order Console:

© 2015 Wolverine Execution Services, LLC