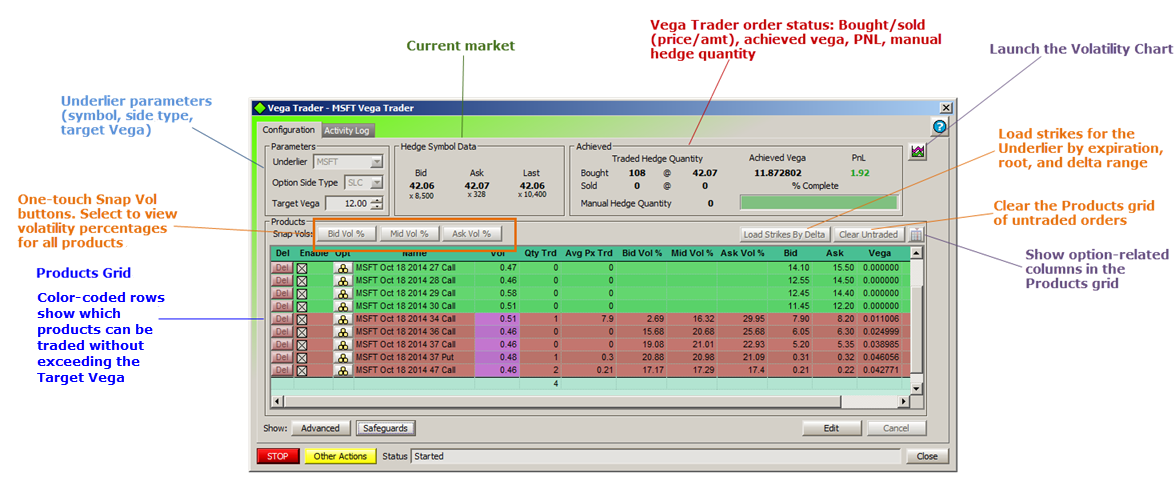

The measure of the impact of changes in the volatility of an underlying symbol (in 1% increments) is an option's vega. The cost of an option is in direct proportion with an underlier's volatility. When an underlier's volatility is high, the cost of an option trends higher, (conversely, lower volatility results in lower option prices). With Vega Trader, WEX users can take advantage of market conditions by defining a target vega amount for a specific symbol (the Underlier). Vega Trader calculates the marketability of a trade based on price volatility and its nearness to the target vega. Vega Trader can also issue hedge orders using the Underlier or any symbol. There are various methods of loading option products into Vega Trader; products defined by their expirations and delta values; via direct input from another applet (using WTP's "send to" feature); or by manually creating an option product with the Option Builder.

With the Managed Order Console selected, enter Ctrl + Shift + B.

Alternate Methods:

From the Action menu,

select New Managed Order -->

Vega Trader

Right-click in the Managed Order Console Grid and select New Managed Order --> Vega Trader

Note: Vega Trader will also launch whenever the "send to-->Managed Order-->Vega Trader" command is issued from another WEX applet.

Once Vega Trader has launched, the Underlier name must be selected along with the side type of the option and a target vega value.

In

the Underlier field enter

a symbol or select one from the drop-down list.

Select

an Option Side Type from

the drop-down list (BYA, BYC, BYO, SLA, SLC, SLO).

Enter

a Target Vega value or

select one using the up/down spinner arrows.

To complete the Vega Trader configuration, the Products Grid must be populated with option symbols. This is accomplished by adding products to the grid with the Option Builder or with the Load Strikes By Delta function.

Add an Option to the Products Grid With Option Builder

An option product can be created directly in the Products grid.

Select the Option Builder button  to begin the process. Learn

more about the Option Builder here.

to begin the process. Learn

more about the Option Builder here.

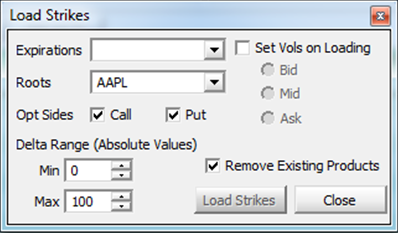

Select Load Strikes By Delta to define the parameters of strikes to be placed in the Products grid. When selected, the Load Strikes window launches.

The Expirations drop-down list features a range of expirations from which to choose. Select one or more expirations and the Opt Side of Call, Put or both using the Call and Put check boxes.

Select one or more Roots from the drop-down list that will be added to the Products grid, or select <All Roots> to load all listed roots.

Set Vols on Loading refers to Vega Trader automatically displaying the current Bid, Mid, or Ask for a product. Check the "Set Vols on Loading" box and select one of the three values. If no selection is made, the Vol column in the Products grid will have all values set at "0".

Delta Range (Absolute Values) allows for the selection of Minimum and Maximum, and is used to define a specific range of values that will, in turn, be placed in the Products grid. For example, a 45 delta option would be included with a setting of 40-minimum and 50-maximum delta. Enter values manually, or by clicking on the up/down spinner arrows.

Remove Existing Products, if checked, will clear the Products grid of all currently-displayed products before loading the strikes.

Select Load Strikes to load requests strikes into the Products grid.

Import Content From Another WTP App

The Product Grid can also be populated

with one or more orders from another WTP app (such as the Option Quote

Cube) using the "send to"

feature.

The Underlier and Option Side Type fields will contain the data from the forwarding app. The Target Vega amount, however, must be entered.

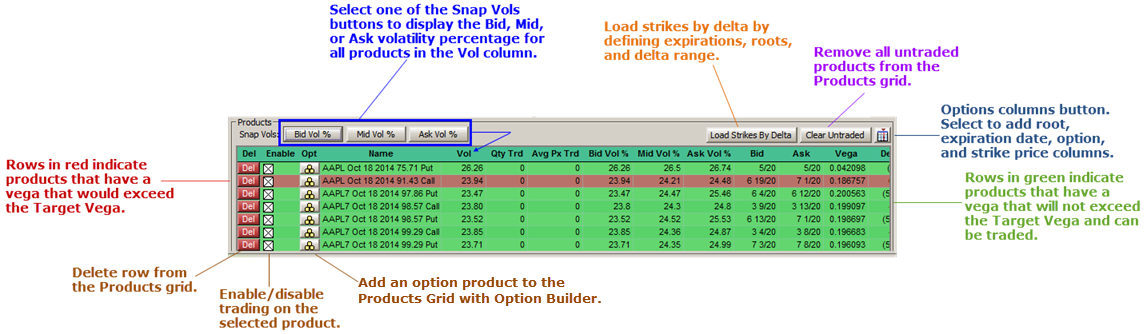

Row Colors and Other Features

The Products grid portion of the Vega Trader window contains the option orders that will be traded once the target vega value has been met. The rows containing products that can be traded without exceeding the target vega are colored green. Rows in red indicate products that would exceed the target vega and will not be traded unless a change in the target vega is made, or the market itself moves in a desirable direction.

Additionally, in the grid, volatility percentages can be adjusted; individual products can be selected for option orders; and products can be deleted or disabled.

Snap Vols

The system default template for Vega Trader contains the volatility-related columns Vol, Bid Vol %, Mid Vol %, and Ask Vol %. A quick shortcut to viewing and editing the volatility percentage found in the Bid/Mid/Ask Vol % columns is via the Snap Vols button.

Select a Snap Vols button and the Vol column will fill with the content found in its related column (i.e., selecting the Snap Vols button "Bid Vol %" will fill the Vol column with the same content currently seen in the Bid Vol % column).

Values in the Vol column can be changed while Vega Trader is in edit mode. Either enter a new value or select one using the up/down spinner arrows.

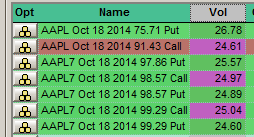

The Vol Column and Marketability

A value highlighted in purple in the Vol column indicates the product is marketable at the given volatility and price (based on the current market).

Clear Untraded

Select Clear Untraded to remove products from the Products grid that haven't traded. The command cannot be undone. Once Clear Untraded has been selected, the Products grid can only be repopulated via the Load Strikes By Delta command or by manually entering new symbols with the Option Builder.

Show/Hide Option Columns

Select the Options

Columns button  to add options-related

columns (root, expiration date, option, strike price) to the Products

grid.

to add options-related

columns (root, expiration date, option, strike price) to the Products

grid.

Delete Rows

Remove one product at a time from the Product grid by selecting the Del button. The function cannot be undone.

Enable/Disable

Enable/disable one or more products from trading by checking/unchecking the check box in the Enable column. To enable/disable multiple products, highlight all the rows that will be acted upon, then issue the command.

Note: Once a product has been traded, it cannot be removed from the grid.

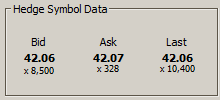

In this portion of the Vega Trader window, the current Bid, Ask, Last values and most recent trade volumes of the hedge symbol are displayed.

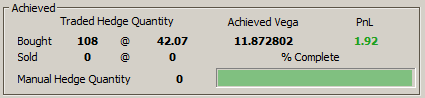

As Vega Trader progresses with the buying and/or selling of securities in the Products grid, its status will be displayed in the Achieved portion of the Vega Trader window. The % Complete slider scale graphically displays Vega Trader's completion status.

The PnL along with the currently achieved vega is displayed. If Vega Trader issued a hedge order, the quantity of the order will be shown here.

Press

the Volatility Chart Viewer

button ![]() to launch the chart.

to launch the chart.

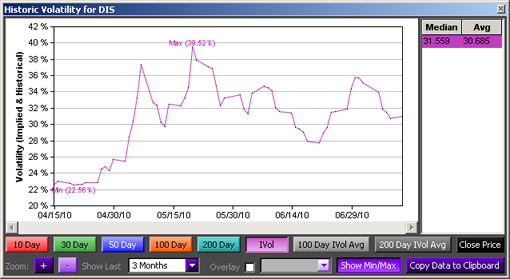

The Volatility Chart Viewer graphs volatility data for a security over selected time periods. If the underlying security in Vega Trader changes, the Volatility Chart will add a new tab to accommodate the new security name.

Learn more about the Volatility Chart Viewer here.

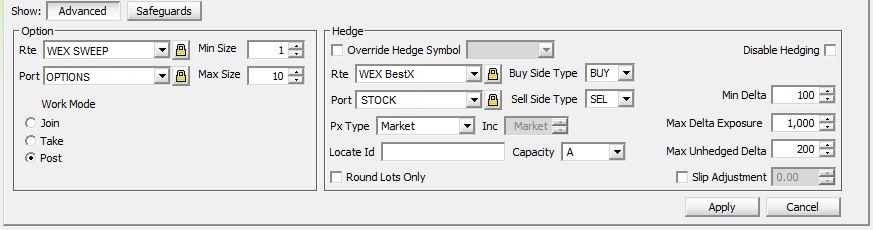

Option Selections

Select the Rte (route)

and Port (portfolio) from

their respective drop-down lists.

A note about Rte (Route) Selection

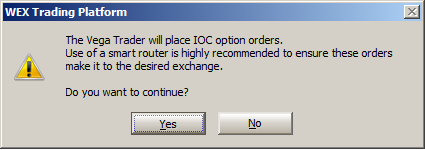

Vega Trader places IOC (Immediate or Cancel) orders exclusively. A

warning message is issued if the selected route is not marked as a

smart router route.

.

If an incorrect route has been selected, responding Yes to the warning message may result in Vega Trader not functioning as desired.

Contact WEX Support with questions relating to IOC routes and Vega Trader.

Min Size

Enter the minimum size of option orders Vega Trader will attempt to

fill.

Max Size

Enter the maximum size of option orders Vega Trader will attempt to

fill.

Work Mode

Join- This mode places option orders

to buy at the bid or sell at the ask when market conditions are valid.

Take- The initial order is only placed when the desired limit is currently achievable in the marketplace. It will only take liquidity.

Post - The initial order will be placed at the most aggressive price allowable without violating the desired limit. This may, or may not, result in the initial order taking liquidity.

While Vega Trader is running, either the target vega will be achieved, or the total contracts limit will be reached. Vega Trader will hedge all remaining delta in either circumstance.

Slip

Adjustment

A slip adjustment is needed to adjust the option pricing when the underlier

price may have changed (before the option is hedged).

The slip amount is used to adjust the underlier price. Check the Slip Adjustment box

and enter a value by which Vega Trader will employ in order to fill

an order.

Max Unhedged Delta

Maximum unhedged delta stops additional delta from being accumulated

by not sending any more option orders. Vega Trader will attempt to

use the maximum unhedged delta value during its calculations if the

Max Unhedged Delta field is checked and a delta value is entered.

Hedge Selections

Override Hedge Symbol

By default, Vega Trader hedges with the same symbol as the Underlier. If it is preferable to hedge a different symbol, check the Override Hedge Symbol box and select a symbol from the drop-down list.

Note: If the Override Hedge Symbol box is checked, the symbol must be different than that of the Underlier.

Rte (Route) and Port (Portfolio)

Select the hedge symbol's Rte (route) and Port (portfolio) from their respective drop-down lists.

Buy/Sell Side Types

For the hedge symbol, select a buy side type (BUY, BYA, BYC) and sell

side type (SEL, SLA, SSE, SSH).

Capacity and Locate Id Fields

Click to learn more about Capacity and Locate ID.

Px Type

From the drop-down list select one of three price types for the hedge order:

BASB (buy at ask, sell at bid)

BBSA (buy at bid, sell at ask)

Market

BASB or BBSA price types must have a corresponding incremental value by which Vega Trader moves in order to fill a hedge order. Set this value in the Inc field.

Note: BASB and BBSA are available for selection only if the Global Configuration option "Allow side relative price types in order tickets (BBSA, BASB, Peg BBSA, Peg BASB)" is checked.

Disable Hedging

To disable stock hedging the Disable Hedging check box must be selected.

Min(imum) Delta

Hedging occurs when the unhedged delta is greater than the minimum delta. Enter a value corresponding to the point at which Vega Trader will begin to hedge an order.

Round Lots Only

Check this box if trading in round lots of 100 is preferred.

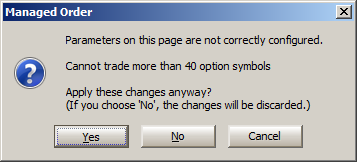

Vega Trader cannot trade more than 40 option symbols for a selected underlier. A warning message will be issued if this is attempted:

Delete or disable products as necessary to reduce the number to 40 or fewer.

If YES is selected, it is possible that the managed order file sent to the server will be too big and the server will reject it. If No is selected, any changes made to the Products grid will be discarded, and the Products grid will revert to its previous state.

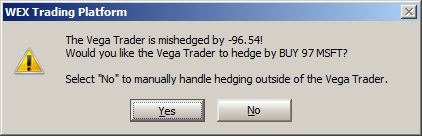

Vega Trader will issue a warning when a mishedged status occurs:

Select Yes to have Vega Trader hedge with a buy/sell order for either the Underlier or for the symbol selected in the Override Hedge Symbol field. Select No to manually hedge with another WTP applet.

© 2015 Wolverine Execution Services, LLC