Spread Agent

Spread Agent

Spread Agent trades two securities based on the difference of their ratio-adjusted prices (or Spread). The difference between Spread Agent and Spread Trader is that Spread Agent can trade a single spread and reverse spreads simultaneously. The reverse spread is achieved by trading the same two securities as the initial spread but with opposing side types (for example BUY/SSH vs. SSH/BUY).

With the Managed Order Console selected, enter Ctrl + Shift + s.

Alternate Methods:

From

the Action menu

in the Managed Order Console, select New

Managed Order -->Spread Agent.

Right-click in the Managed Order Console grid and select New Managed Order -->Spread Agent.

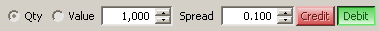

Quantity, Value, Spread Value, Credit and Debit

Quantity

(Qty) or Value—This input

is a convenient way to specify the Max

Position for each security in the corresponding spread.

Whenever a Max Position configuration needs to be updated, it

is computed from this input as follows:

Quantity—This will be multiplied

by the corresponding Ratio

at the time of the computation.

Value—This will be divided

by the market price of the corresponding security at the time

of the computation.

Note:

The amount in the Max Position field will be rounded to the nearest

hundred if Round Lots Only

is checked.

Spread—The

difference of the ratio-adjusted

prices of two securities. It must be greater than or equal to

zero. The value placed in the field works in conjunction with

the Credit/Debit buttons (below).

Credit/Debit—If

a spread value is to be collected it is a Credit.

If a spread value is to be paid, it is a Debit.

A credit occurs when the security with the lower

ratio-adjusted price is bought, and the security with

the higher ratio-adjusted

price is sold.

A debit occurs when the security with the higher

ratio-adjusted price is bought, and the security the

lower ratio-adjusted price

is sold.

Select either Credit or Debit when setting up a spread.

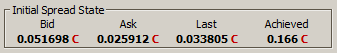

Bid, Ask, Last, Achieved, and Set as Spread

The value displayed in the Bid field is the computed spread of the two securities if they were bought at the bid and sold at the ask prices of the current market.

The value displayed in the Ask field is the computed spread of the two securities if they were bought at the ask and sold at the bid prices of the current market.

The value displayed in the Last field reflects the most recent spread quote.

The value displayed in the Achieved field is the spread achieved from the average executed prices of the securities.

Note: The Bid, Ask, Last, and Achieved values may fluctuate as the market moves.

Set as Spread—You can select the Bid or Ask value to be the spread amount. Right-click on either the Bid or Ask field and select Set as Spread. The spread will instantly change to match the selected Bid or Ask value.

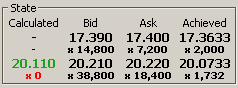

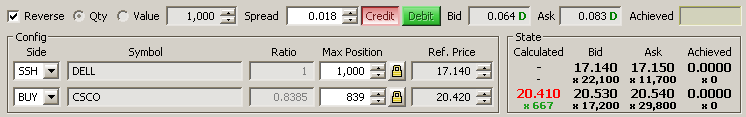

State of the spread. The bottom value in green (20.110) reflects that the corresponding security's initial order is marketable.

The values displayed in the State portion of Spread Agent reflect:

The Calculated price.

This is the price that Spread Agent needs to place the corresponding

security's initial order at in order to achieve its spread. This

is all inclusive of the spread configuration, current market prices,

and slip adjustments.

The side(s) being worked first. In the image above, the bottom

security is able to place initial orders so its calculated price

is shown. The top row shows dashes because only the bottom security

is configured to be worked first. See advanced

parameters for instructions

on how to define the side that is to be worked first.

The side that is being worked will be displayed in one of three

colors, depending on market conditions:

Green The order is marketable.

Yellow

The order is placeable,

but not marketable.

Red The order is not placeable because

it is too far outside the market.

Bid & Asked Values based

on the current market quotes.

Bid is the current market's

Bid price and below it is the current executed quantity of the

security.

Ask is the current market's

Ask price and below it is the current executed quantity of the

security.

Achieved is the average price and quantity that have been executed by Spread Agent.

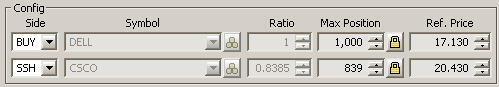

Sides, Side Types, and Symbols—Generally,

each spread will have one security with a buy side type and another

with a sell side type. However, two like side types may also be

chosen (i.e., BUY and BUY).

In the Symbol field,

either manually type in a symbol name or select one from the drop-down

list.

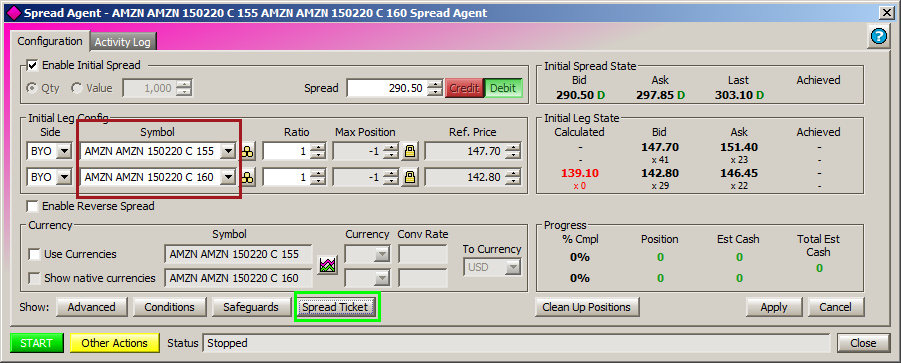

Set Spread

Agent for Options

Spread Agent can be set to send initial and hedge orders as Options.

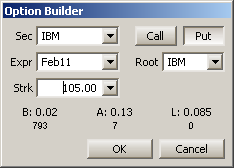

a. Press the

Build

Option button ![]() (located next to the Symbol

field). The Option Builder window (above) will appear.

(located next to the Symbol

field). The Option Builder window (above) will appear.

b.

Enter the necessary data in

each field (security, expiration date, strike price, call or put,

and root).

c.

Select OK to

accept the values or Cancel to exit without savings.

d.

Repeat for the other side,

if desired.

Ratio—The

ratio values are applied to their corresponding security's prices

whenever calculating a Spread value. This allows for the normalization

of the price of each security so that it will have an appropriately

weighted effect on the resulting Spread value. When the Symbol

input is modified, these values are snapped to the ratio of the

current market prices.

Max Position—The

maximum position (in shares) that Spread Agent may have open for

the corresponding security and side. If the Reverse spread is

enabled, Spread Agent will trade both sides of a security without

exceeding the position specified for each side. If the Reverse

spread is disabled, Spread Agent will finish once each security's

position is achieved. Pressing the lock button  will prevent this value from being snapped as a result of other

configurations (Qty, Ratio, Symbol, etc.) being modified.

will prevent this value from being snapped as a result of other

configurations (Qty, Ratio, Symbol, etc.) being modified.

TIP FOR SETTING MAX POSITION: It

is common to have a Locate

ID for a Short Sale

(SSH) of a certain amount of a security. In that case, it may

be beneficial to limit the position on the sell side more than

on the buy side.

Ref. Price—The reference price influences the value of the desired spread. If this value is modified, the spread will change accordingly.

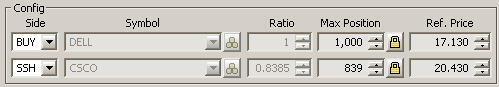

Initial Spread

Reverse spread uses side types that oppose those in the initial spread

A second (or Reverse) spread is achieved by trading the same two securities with the same ratios as the first spread. However, the reverse spread must use side types that oppose the side types used by the first spread. In the images above, the initial spread uses the BUY side type for the first security, while the Reverse spread uses the SSH side type for that same security.

Check the Reverse box to reveal the reverse spread parameters. The configuration parameters are set up in the same manner as the regular spread. If Reverse is not checked, Spread Agent will only work a single spread and will not display the reverse spread parameters.

Note Regarding Reverse Spread and Hedge Orders: When using a reverse spread, Spread Agent may close out a position instead of hedging it. If an initial order fills before an opposing hedge order of the same security, the hedge order will be canceled. If there are multiple live hedge orders, the hedge order with the worst price will be canceled.

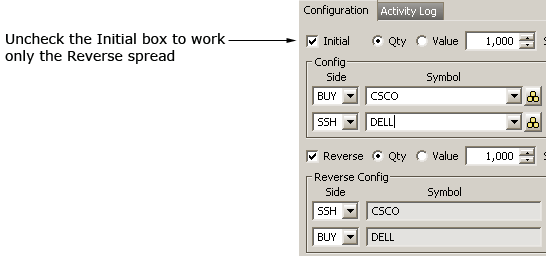

Disable the Initial Spread and Work Only the Reverse Spread

When it's preferable to work only the Reverse spread, the Initial spread can be disabled.

The Initial check box can be unchecked while Spread Agent is running. The order change will be reflected in the Managed Order Console in the Summary column:

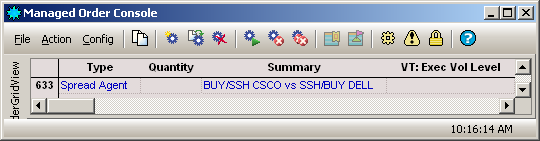

The Managed Order Console lists Spread Agent with both Initial and Reverse spreads.

The Managed Order Console displays only the Reverse Spread when the Initial Spread is disabled.

Note: At any time while Spread Agent is running, the initial spread can be worked again by checking the Initial check box.

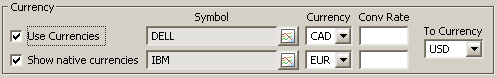

By default, Spread Agent trades in U.S. dollars, but different currencies may be selected.

Choose a different currency:

Check

the Use Currencies

box.

From

the drop-down list, select a currency for each side. The State values

in the Calculated

fields will be adjusted for the selected currency.

Note: The conversion rate is computed

automatically.

Show Native Currencies

The "Show native currencies" check box is available when Use Currencies is checked. The State values (Bid/Ask) will display the security's selected currency value.

Show/Hart Chart

To

view historic volatility data for a security, press the show/hide

chart button  (next to the symbol name).

(next to the symbol name).

Clean Up Positions, Progress, Position, Estimated Cash

Selecting the Clean Up Positions button causes Spread Agent to trade only in the direction that will bring the daily positions within each individual spread agent to zero. Once a position of zero is reached, Spread Agent status is "finished". If the Clean Up Positions button is in the "up" position Spread Agent will respond as before by working the defined spread.

The Estimated Complete Values indicate the percentage of completion of the spread order (and reverse order if applicable). The top value refers to the first security in the spread, the second number refers to the second security.

% Cmpl shows the security's executed quantity as a percentage of the security's Max Position. Note: This value is not applicable when working two spreads.

Position refers to the Spread Agent's daily wave position.

The Estimated Cash fields indicate the profit/loss currently estimated as each spread is being worked. The Total Est Cash is the estimated profit/loss from the entire spread order. These cash values are the PNL that Spread Agent would realize if its positions were closed at current market prices.

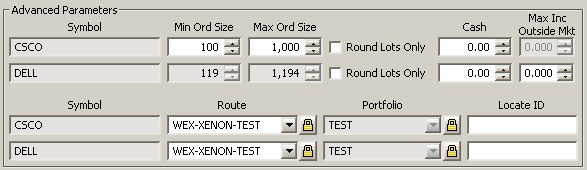

Press the Advanced button in Edit mode to reveal additional configuration options for Spread Agent. Minimum/maximum order size, round lot selections, and additional cash amounts to add to a spread order are configurable here.

Min Ord Size

The minimum order size is considered firm in that an initial order will be placed at the minimum amount if market prices allow it even if the market quantities do not.

Define the minimum order

size in shares for a security by entering the value directly or by

using the up/down arrows. The value for bottom symbol changes as the

top symbol is edited. Only one symbol can be edited for Min Ord Size

and the other will be snapped based on the ratio of their Max Positions.

In cases where the first symbol is an equity and the second symbol

is an option, both can be edited.

Note: The minimum order size cannot be larger than the Max Ord Size.

Max Ord Size

The maximum order size specifies the largest quantity that may be placed for any single order of its corresponding security. Also, it specifies the quantity that may be executed above the achieved quantity of the opposite security (after adjusting for the ratio of the quantities that are remaining before the Max Positions will be reached).

Define the maximum order

size in shares for a security by entering the value directly or by

using the up/down arrows. The value for bottom symbol changes as the

top symbol is edited. Only one symbol can be edited for Max Ord Size

and the other will be snapped based on the ratio of their Max Positions.

In cases where the first symbol is an equity and the second symbol

is an option (or vice versa), both can be edited.

Note: The maximum order size cannot be smaller than the Min Ord Size.

Round Lots Only

Round Lots Only will cause Spread Agent to try and place order quantities that are rounded to a multiple of 100. The one exception is that partial fills of orders may force Spread Agent to break this rule and place a non-round lot to prevent a state where it cannot trade. When Round Lots Only is checked, the Order Sizes and Max Positions must be configured to multiples of 100.

Note: A Min Ord Side will be rounded down to the closest multiple of 100 (i.e., 175 shares will round down to 100), while a Max Ord Size will be rounded up.

Cash

This value refers to the amount of

cash added to a trade.

For example, in a merger situation, for each share of AGE stock, WB

is offering .9844 shares of its stock plus $35.80 in cash.

The current price of AGE is $82.36 and WB is $48.82. The offer value

per share is $83.86 (.9844 x 48.82) + 35.80 = $83.86

$83.86 - $82.36 = $1.50 credit.

Note: The values entered in the Cash field affect the spread value. As a single cash value increases, the spread is increased to account for the additional amount. If a single cash value exists, increasing the opposite cash value reduces the spread value as one cash value works against the other.

Max Inc Outside Mkt

The Max Inc Outside Mkt refers to the threshold outside of the current market that Spread Agent will place initial orders. The state of the order reflects the Max Inc Outside Mkt value. Specifically, if the state is yellow it indicates the order can be placed, even if it isn't marketable. This is used in conjunction with the Work Mode.

Note: Increasing the Max Inc Outside Mkt is likely to cause Spread Agent to generate more order flow, so it should be used with caution.

Route and Portfolio

Both Route and Portfolio must be selected from their drop-down lists before Spread Agent can initiate a spread order.

Note: Both routes and portfolios can have their values locked by pressing the lock icon.

Learn how to set up default routes and portfolios here.

The Locate ID field is used in conjunction with SEC regulation SHO which requires a locate identifier for short sales in all equity securities. Usually, a locate ID number is entered prior to effecting the short sale. Enter the locate ID in for either symbol in Spread Agent.

Work modes, coupled with Max Inc Outside Mkt, determine at what levels Spread Agent will place orders (relative to current market prices and quantities). These configurations have a direct effect on the amount of order flow generated by Spread Agent.

Spread Agent is set to run in one of three modes:

Join—An initial order will be

placed at the buy bid/sell ask price when the calculated price

of the security is as good as, or better than, the current marketable

price (less the Max Inc Outside Mkt adjustment).

Eye—The

Eye feature enables the Work Bid or Offer mode to place an IOC

(Immediate or Cancel) option order to buy at the ask or

sell

at the bid to try

and capture marketable liquidity before falling back to its default

behavior. To

use this feature, Spread Agent must be in Work Bid or Offer mode

and the configured option route must support a Time In Force of

IOC. It is highly recommended to use this feature

with a WEX smart router for orders to capture liquidity reliably.

Post—An initial order will be

placed at the calculated price of the security when that price

is as good as, or better than, the current marketable price (less

the Max Inc Outside Mkt adjustment).

Take—An initial order will be placed at the current marketable price when the calculated price of a security is as good as, or better than, the current marketable price (less the Max Inc Outside Mkt adjustment). The quantity of the initial order will be at most the amount currently available in the market.

Work Side First

Spread Agent can be instructed to work either or sell side first for a spread or reverse spread. If enabled, the selected side will send out orders based on the achievability of the spread.

The side not selected will place orders only when they are needed to hedge.

Check the

Work Side First

box to enable the feature.

Select the side to work first from the drop-down list.

For reverse spreads check

the Reverse Work Side First

box and make a selection from the drop-down list.

Note 1: When Work

Side First is unchecked, Spread Agent will place initial orders for

both securities simultaneously

(assuming the spread is achievable on both sides of the market).

When one or both initial orders fill, they will be hedged with the

opposing security in the same way as when working only one side.

Note 2: If trading an option and a stock, Spread Agent will force the option side first.

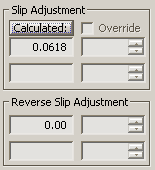

Slip Adjustment

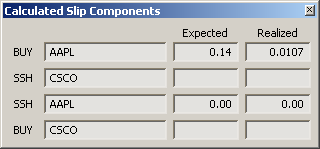

Calculated Slip Components

A Slip occurs in Spread Agent when it attempts to achieve a spread, yet fills a portion of the order at a worse than configured price. Spread Agent will attempt to rectify this situation by adding a calculated amount that's spread over the entire order (known as the Slip Adjustment), with the result of a completed order at the desired price.

The following conditions could cause a slip adjustment to occur (note this is not a comprehensive list):

An

initial order is filled, but the opposite security's market has

moved before the hedge order was placed.

Round Lots Only has been

selected and a partial fill of an initial order occurs that cannot

be hedged immediately due to the round-lots demand.

Stopping

before Spread Agent is fully hedged, and then restarting after

the market has moved.

A Stop Loss has been hit. The amount of the slip incurred will be directly proportional to the amount of loss.

The values displayed in the Calculated window are price adjustments that will be applied to the expected hedge security's price during initial order price calculations. The effect of the slip adjustment is reflected in the State Calculated prices. In the Slip Adjustment image (above), when calculating the price of an initial order for the sell side, Spread Agent must assume a hedge price that is 0.618 worse than the current market price in order to achieve its spread.

Pressing the Calculated button opens the Calculated Slip Components window. This read-only window displays the components that caused the calculation.

Expected—The average of

how much the hedge order of the security has missed its expected

price during the runtime of this Spread Agent. This will reset

once orders from previous trading have been cleared from the system.

TIP: A lower Max Ord Size relative

to the Max Position

can improve the accuracy of the expected slip since the average

will smooth out over a larger order history.

Realized—The amount that the price

of a hedge order needs to be adjusted in order to make up the

incurred slip by the time Spread Agent reaches its max position.

This will reset once orders from previous trading have been cleared

from the system.

For example: If Spread Agent has missed the desired spread so far,

incurring a $100 deviation from the total desired value, the realized

slip adjustment would be $100 divided

by the quantity remaining until the Max Position is

achieved.

Note: By default, the Slip Adjustment is set to 0.00 (i.e., the feature is turned off).

Override Spread Agent's Slip Adjustment

You can override the dynamic values that Spread Agent has calculated for achieving a spread with custom defined values. In edit mode, check the Override box and either manually enter a value or use the up/down arrows to define a value. Once the order has started again, the override value can be adjusted without the need for entering the edit mode.

| Caution is advised when using the override. Spread Agent's dynamic Slip Adjustments will be ignored when the override is enabled. This introduces risk that the desired Spread may not be achieved when the occurring slip is larger than the configured adjustment. There is also risk that Spread Agent will be less aggressive if the occurring slip is less than the configured adjustment, causing market opportunities to be missed. |

Launch Spread Ticket from Spread Agent

The Spread Ticket launch button is available for selection when a valid option leg is present in the symbol field. In the image above, two legs are listed in the initial spread. Select Spread Ticket to launch the app with the symbols in place.

A number of status messages can be displayed in Spread Agent. Some are reactive to the safeguards in place (i.e., "past automatic shutoff time") while others report an error or status of the spread order. Here are just a few of the more common status messages:

No unhedged initial order prices exist when a hedge order needs to be placed

An order cannot be initialized

An order reject is received

Either side's route becomes unavailable

Required option quote sources are missing from the global configuration

Any required market data record is missing data

Any enabled trading Condition is not true

The current and reverse spreads are crossed

© 2015 Wolverine Execution Services, LLC