Time Slicer

Time Slicer

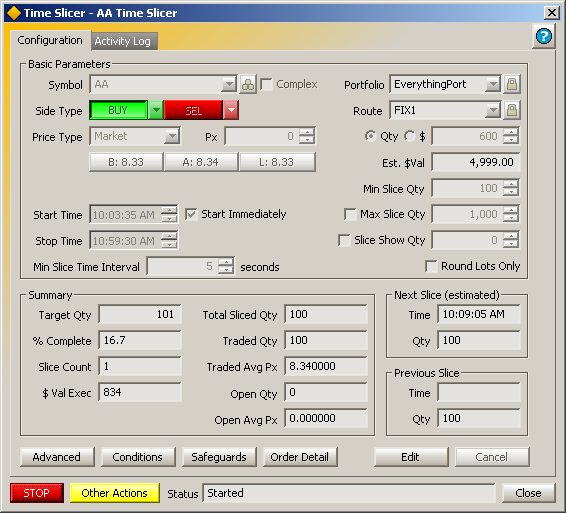

Time Slicer spreads trades on a single product over a defined time period. Configuring the start and stop times, minimum trade quantity, and interval between "slices" (portions of the total order) avoids flooding the market with a large order. Time Slicer can also be configured to trade Spread orders. Additional controls allow for the randomization of Time Slicer intervals and/or quantities.

From the Managed Order Console type Ctrl + Shift + t.

Alternate Methods:

From

the Action menu

in the Managed Order Console, select New

Managed Order -->Time Slicer

Right-click in the Managed Order Console grid and select New Managed Order -->Time Slicer

The following fields must be specified to start a Time Slicer order:

Symbol—Type a symbol or select one from the drop-down list.

Note: Press the Build Option button (next to the Symbol field)

to configure Time Slicer to trade Options.

Side Type—Select a BUY or SELL side type from the drop-down list.

Price Type—Select a price type from the drop-down list.

Inc/Px—Depending on the selected Price Type, either an incremental value or price amount is entered in this field.

Press the Bid/Ask/Last buttons to enter the selected amount in the Px field.

Note: When the Price Type is Market, a Px value cannot be entered. If a Bid/Ask/Last button is pressed, the Price Type will change to Limit.

Portfolio and Route—Select a portfolio and route from their respective drop-down lists.

Note:

Press the lock button  next to the Portfolio and

Route fields to save those values if the symbol field is changed.

The values will not be saved when opening a new Time Slicer window.

next to the Portfolio and

Route fields to save those values if the symbol field is changed.

The values will not be saved when opening a new Time Slicer window.

Qty or $—To have Time Slicer attempt to fill an order based on the number of shares to buy or sell, select Qty and enter the number of shares. The Est. $Val field will display the value of the shares.

To fill an order based on the total price, select $ and enter a dollar value. The Est. Qty field will display the equivalent number of shares based on the dollar value.

Min Slice Qty—Enter a value corresponding to the minimum number of shares (i.e., the slice) Time Slicer will attempt to fill.

Note: Optionally, check the Max Slice Qty box and enter a value corresponding to the maximum slice size that Time Slicer will place.

Slice Show Qty—When enabled, the entered display value is applied to all sliced orders sent. The show quantity will be displayed as long as its value is less than or equal to the slice's order quantity.

Round Lots Only—Check this box if Time Slicer is to send equity orders in multiples of 100.

Start Time/Stop Time—Enter the start and stop parameters when Time Slicer can trade.

Note: Check the Start Immediately box to have Time Slicer trade as soon as the order has started.

Min Slice Time Interval—This value (expressed in seconds) refers to the minimum time interval that Time Slicer will attempt to trade the minimum slice quantity.

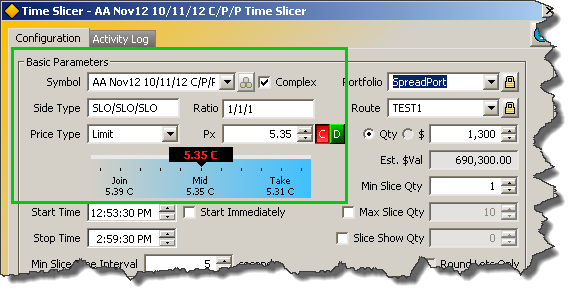

A spread order originating in Option Quote Cube sent to Time Slicer

Time Slicer has the ability to support spread orders.

The send to feature can be used to send spread parameters from a WTP applet (such as Option Quote Cube or Spread Trader).

Spread parameters can be manually entered as well by checking the Complex box and filling in values into the Symbol, Side Type, and Ratio edit boxes.

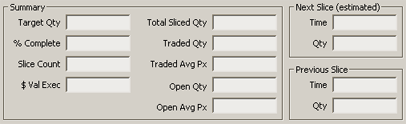

Time Slicer displays an order's status in the Summary section.

Target Qty—Time Slicer sends an order when the Target Quantity is greater than the sum of Total Sliced Quantity and the Next Slice (estimated) quantity.

In the image above, 400 (Total Slice Quantity) + 600 (Next Slice estimated) = 1000

Time Slicer will send an order when the Target Quantity is greater than 1000.

Note: The behavior of Time

Slicer with regard to the Target Quantity is only true if Randomize

Slice Quantity is not enabled. See advanced

parameters below for the description of the randomize feature.

% Complete—The percentage of completeness for the entire quantity or dollar amount.

Slice Count—The total number of traded and open orders.

$ Val Exec—The dollar amount refers to the total dollar amount executed by a Time Slicer order. It is calculated by multiplying the traded quantity by the traded average price.

Total Sliced Qty—The sum of all traded and open shares.

Traded Qty—The total number of traded shares.

Traded Avg Px—The average price for all trades.

Open Qty—The number of shares still waiting to be traded.

Open Avg Px—The average price of the shares waiting to be traded.

Next Slice/Previous Slice

The Next Slice field displays the estimated time and quantity of the next slice. These values are determined by Time Slicer based on market conditions.

The Previous Slice displays the time and quantity of the most recent slice.

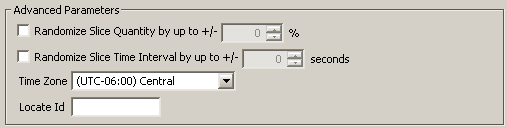

Randomize Slice Quantity and Time Interval

Each slice is typically placed using a consistent time interval and quantity. The quantity can be varied by a defined percentage.

Similarly, the minimum slice time interval can also be varied by a value in seconds. However, the Time Slicer will never violate the Min Slice Time Interval or Min Slice Qty values.

Check either box to activate the advanced parameter. For Random Slice Quantity enter a percentage value. For Random Slice Time enter a value representing seconds.

Time Zone

From the drop-down menu, select the appropriate time zone. The time zone selected works in conjunction with the Start Time and Stop Time basic parameters.

Locate ID

Per SEC regulation SHO, traders are required to locate securities available for borrowing prior to effecting a short sale. Consequently, an identifier can be added in the Locate ID field.

Both numbers and letters can be used in a Locate ID, but there is a 16-character limit.

One or more expressions can be defined that allows trading under specific circumstances. Press the Conditions button to open the Conditional Trading window.

Learn more about defining conditions here.

Safeguards can offer an additional layer of protection for the trader with features such as limiting the number of open orders, order cancelation, and price boundary checks.

Learn more about safeguards here.

© 2015 Wolverine Execution Services, LLC